The patterns may be considered rising or falling wedges depending on their direction. O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers. Wedge patterns are usually characterized by converging trend lines over 10 to 50 trading periods. Wedges can serve as either continuation or reversal patterns. A Rising Wedge is a bearish chart pattern that’s found in a downward trend, and the lines slope up. Below are various ways to trade the falling. A Falling Wedge is a bullish chart pattern that takes place in an upward trend, and the lines slope down.

#Trading descending wedge how to

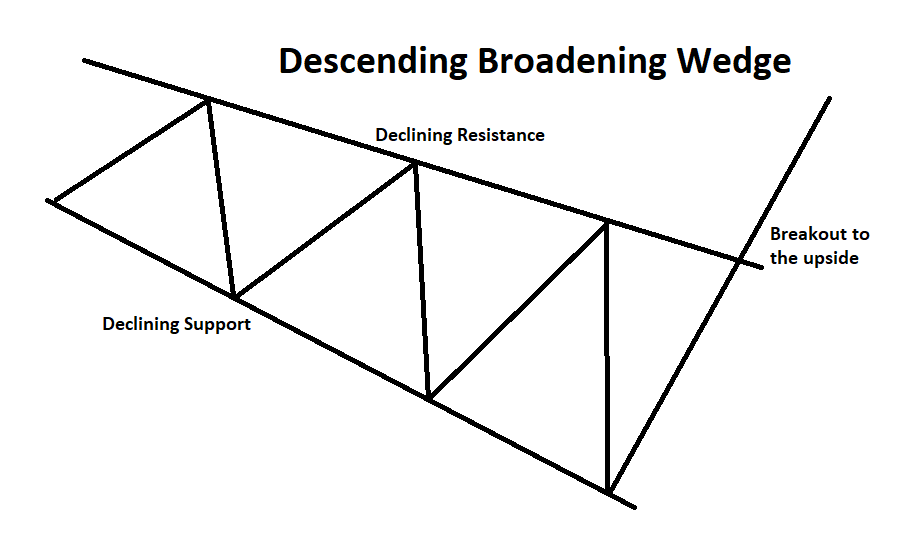

Volumes have continued to decline and trading activity has slowed due to falling prices. Identify an uptrend or (downtrend) HOW TO TRADE THE FALLING WEDGE PATTERN. Get High-Probability Trade Setups: A Chartist's Guide to Real-Time Trading now with the O’Reilly learning platform. The top line descends at a steeper angle than the bottom line. If the stock is in a broad uptrend, the descending wedge is a continuation pattern if the stock is in a broad downtrend. Whether the stock is in a general uptrend or downtrend doesn't matter. As long as the price bars between the lines are moving lower ( descending) and the lines are angled such that they will eventually converge on their right side (wedge), the pattern is valid. The descending wedge is bounded by these two lines.

The second way to trade the falling wedge pattern is to find a long bullish trend and buy the asset when the market contracts throughout the trend. The two trendlines look parallel, but the higher one is descending at a slightly faster rate than the lower one. A good take profit could be somewhere around the 38.2 or 50 Fibonacci levels. A rising wedge is essentially a bearish chart pattern that forms when. The graph of FEI Company (symbol FEIC), shown in Figure 8.1, went up 56 percent after its breakout from the descending wedge pattern. Trading the rising wedge is a popular strategy among technical analysts and traders. If and when the prices break the upper trendline, the descending wedge pattern is complete, and the stock should move higher in price. As the price bounces up and down between the two extremes, the price action becomes more compressed as the bullish and bearish reactions draw the lines closer together. It consists of two nonparallel lines that, if extended, will meet on their right side. Just as an ascending wedge (see Chapter 4) is a bearish pattern, the descending wedge is a bullish pattern. This is sometimes the case, but there are some instances in which the stock is in fact creating a very bullish pattern known as the descending wedge. Bullish signals in the PRZ area are: - Dynamic Support -Broadening Wedge Note if the Dynamic Support is broken downwards with the strength.

Usually when a person is watching a stock's price steadily sink, the assumption is that the stock must be in trouble. falling wedge pattern it means that the price would increase and the price has already broken the pattern and Pullback is complete it.

0 kommentar(er)

0 kommentar(er)